Should You Rent or Buy a House? As someone who stayed in rent for many years, I can understand where this question is coming from.

Not only that I’ve seen countless people grapple with this question. It’s a big decision after all.

And there’s no one-size-fits-all answer. Lots of context is required before I can give you a concrete answer. When I say about context I mean to say your background, current financial status, etc.

But don’t worry, I’m here to help you figure it out.

Let’s dive into the world of renting versus buying, and I’ll show you how to decide what’s best for you.

We’ll look at when you should buy when you should rent, and all the important stuff in between.

By the end of this guide, you’ll have a clear picture of which path is right for you.

Table of Contents

The Big Picture- Renting vs Buying

Before we get into the nitty-gritty, let’s take a step back and look at the big picture. More like a general overview.

Renting and buying are two very different approaches to finding a place to live, and each has its own set of pros and cons.

Let me give you a general view, these are more like a foundation to understand the other aspect of Renting vs Buying a house.

Renting- The Flexible Option

When you rent, you’re essentially paying for the right to live in a property for a set period.

As you don’t own the place you typically don’t have to care about a lot of hassle that comes with owning a house, you pay rent and live.

Pros of Renting

- Flexibility: You can move more easily when your lease is up.

- Lower upfront costs: No need for a big down payment.

- Predictable monthly expenses: Your rent is usually fixed for the lease term.

- Less responsibility: The landlord typically handles repairs and maintenance.

Cons of Renting:

- No equity building: Your rent payments don’t go towards owning anything.

- Limited control: You can’t make major changes to the property.

- Potential rent increases: Your landlord might raise the rent when you renew your lease.

- Less stability: The landlord could decide not to renew your lease.

Is it cheaper to rent or buy

While renting may be cheaper short term sometimes [Less than 5 Years], buying saves money over a longer period.

Let’s take an average home priced at $400,000. A 30-year mortgage at 6.5% will have a monthly payment of around $2,023 (excluding taxes and insurance).

On the other hand, the average rent for a similar home could be $2,500 per month, with rent rising yearly.

Key Points

Short-term stay (less than 5 years): Renting is often cheaper due to lower upfront costs.

Long-term stay (more than 5 years): Buying may save money in the long run due to equity growth and fixed payments.

Is It smarter to rent or buy a home?

In my opinion, Assuming you are stable enough. Buying a Home will be a smarter move over both shorter and longer periods.

From creating a financial asset to developing an inner sense of gratitude, it is smarter to buy a home.

Let me back this up with Data.

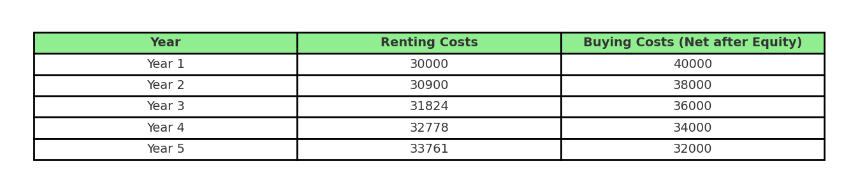

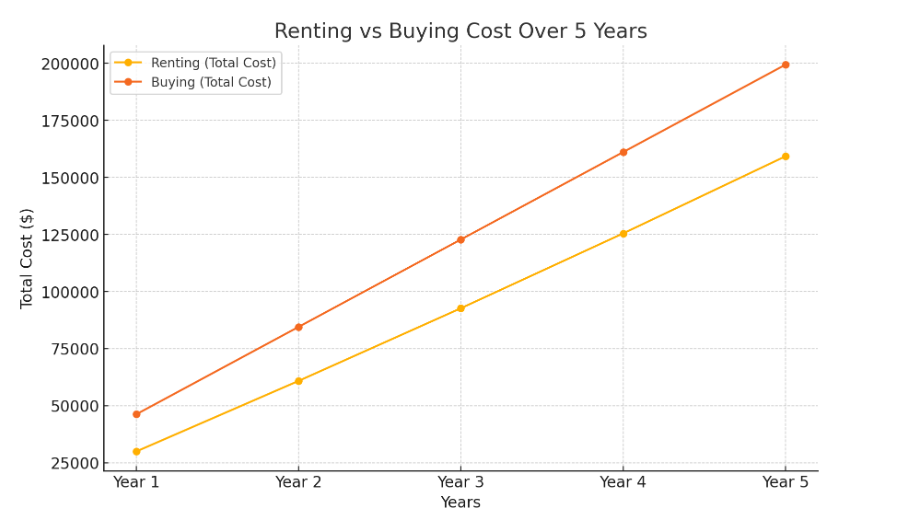

The chart above shows a comparison between the total costs of renting and buying a home over five years.

Renting Costs – The line for renting shows that the total cost increases each year. This happens because rent goes up over time (about 3% each year in this example). After five years, the total rent paid adds up to more than $160,000.

Buying Costs: The buying costs are higher in the first year because of the extra expenses like the down payment and closing costs.

However, the costs grow at a slower rate after that. By the end of five years, the total cost of buying is about $136,000.

Key takeaway– While renting may seem cheaper upfront, over time, buying a home can save money because you build equity and benefit from the home’s value increasing.

Should a Single person Rent or Buy

Single people should only rent if they love and value flexibility, have uncertain income, or plan to relocate due to work.

Single people should buy a house when they are sure that they want to stay long term at least 5 years and have financial stability and want to build equity.

Lastly, there is pride and emotion which you cannot measure by unit.

When Should You Buy a House?

Buying a house is a big step, and it’s not right for everyone at every stage of life. It’s a very personal question if you ask me personally.

Everyone has their own pace and their timeline, and based on that you should think of buying a house.

However, I’m listing out some situations where buying might be the smart move –

1. You’re Financially stable

This is probably the most important factor. Honestly often neglected due to ego war and proving to others that yes we are financially stable.

Buying a house is a long-term commitment, and you need to be sure you can handle the financial responsibility. I know you can 🙂

But if comes the tricky part I would say, the term financially stable can be misunderstood very easily to avoid any silly confusion I have mentioned an outline.

Here’s what financial stability looks like according to me.

Steady income– You have a reliable job or income source that you expect to continue for the foreseeable future.

Good credit score– The higher your credit score, the better interest rate you’ll likely get on your mortgage.

Having a good credit score will not only help you get a good mortgage rate but it will also work in other places like when you are trying to lease a vehicle.

A good credit score is just like your report card which says a lot about your financial habits. If its good that means you are responsible with money.

Savings for a down payment– Typically, you’ll need to put down 15-20% of the home’s value, although this depends on various factors like your credit score, negotiating skills, and ability to repay.

Emergency fund– You should have savings to cover unexpected expenses or temporary loss of income. It can be 6-12 months of monthly income. and if you are conservative you can go as high as 24 months.

Also Read – Down Payment: How Much You Need and How to Save for It

2. You plan to stay put for a while

Buying a house makes the most sense when you plan to live in it for at least 5-7 years. I’m talking about bare minimum.

You may ask me Why?

Well, there are many reasons like costs associated with buying and selling a home (like real estate agent fees and closing costs, home furnishing costs, etc).

If you move too soon, you might not recoup these costs.

Also Read – Long-Term Investment: Why Real Estate Can Be a Smart Choice

3. You want to build equity

One of the biggest advantages of buying a home is that you’re building equity with each mortgage payment.

Part of your payment goes towards the principal (the amount you borrowed), reducing your debt, and increasing your ownership stake in the property.

Although Initially, a large chunk goes towards paying the interest, over time major chunk goes towards your principal.

Over time, this can add up to significant wealth. Plus, as your home appreciates in value, your equity grows even more.

Also Read – Building Equity: How Home Ownership Can Boost Your Financial Future

4.You’re ready for the responsibilities of homeownership

Owning a home comes with a lot of responsibilities that renters don’t have to worry about. You’ll need to be prepared to:

Handle repairs and maintenance

Pay property taxes and homeowners insurance

Keep up with mortgage payments

Deal with any homeowners association (HOA) rules and fees

If you’re ready to take on these responsibilities and see them as part of the investment in your property, then buying might be right for you.

Honestly, if you are reading an article on the Internet on renting vs buying a house I can say you are good with research and you can easily deal with Repairs and Maintenance.

Property Tax, homeowners insurance, and mortgage payments these three can be easily tackled if you have a stable income coming every month.

Also Read – Home Ownership Costs: What to Expect Beyond Your Mortgage

5. You want stability and control

When you own your home, you have a level of stability and control that renting doesn’t offer. I’m talking about both physical and mental, wait let me explain.

You don’t have to worry about a landlord deciding to sell the property or raise your rent at his whims.

Love playing guitar at night, well go for it, want to bring a few friends and throw a small party, definitely. or plant a garden without asking anyone’s permission.

This stability becomes super important if you have a family, or kids or want to plan one.

I don’t know how to explain this to you but there is a different peace when you work hard in your office and come back to YOUR OWN HOME and have a cup of coffee or soda.

Honestly you will love it.

Also Read – Emotional Benefits of Homeownership: Beyond the Financial Gains

6. The housing market in your area favors buying

Sometimes, the local real estate market makes buying a particularly attractive option. Assuming you fulfilled the previous points.

This might be the case if-

- Home prices in your area are rising steadily, making it a good investment

- Rent prices are high compared to mortgage payments

- There are tax incentives for homeowners in your area

- Distress sell or simply you came across a very good opportunity.

It’s always a good idea to research the local market, Facebook marketplace, or even Zillow at times.

Or you can consult with a real estate professional to understand the trends in your specific area.

You don’t have to outright tell him that you plan on buying, just have a normal conversation that you are interested but not sure. But would like to explore the possibility.

In the long run, this gives you an upper hand of you end up liking a property.

Also Read – Home Appreciation: Understanding How Property Values Grow Over Time

7. You’re looking for potential tax benefits

Homeownership can come with some tax advantages. For example, you may be able to deduct mortgage interest and property taxes from your income taxes.

While these shouldn’t be the primary reason for buying a home, they can be a nice bonus.

If you are just looking for potential tax benefits I would say go for it. You have arrived buddy !!

Also Read – Tax Deductions for Homeowners: Maximizing Your Financial Benefits

8. You want to invest in real estate

Buying a home isn’t just about having a place to live – it’s also an investment. Remember!

If you’re interested in building wealth through real estate, buying a home can be a great first step.

But there is more complexity involved you need to be very good with information and research. From Potential finding potential locations to understanding rental yield. There’s more to it.

You might even consider buying a multi-unit property, living in one unit, and renting out the others.

But If you want it from my end you can just mail me out I will send you a 10-page PDF guiding you on “Multi-Unit Property Investing”. It will cost you $59. In the bottom section you will find the contact information.

Also Read – Investing in Real Estate: Strategies for Building Wealth Through Property

9. The Age Bar

I might be getting a ton of bombastic side eye but sorry for it!

After a certain point of time, one should have a permanent place where they can call home, it is not a house but a home where you feel warmth and cozy.

According to me, the age is 35 years to 50 years. This is the time when you should really look for a place to call it your home and you have reached to mental maturity where you can take responsibility for paying the mortgage and taking care of things.

Retirement Plans:

If you’re nearing retirement, consider whether you want to age in place in a home you own, or if you’d prefer the flexibility of renting.

When Should You Rent?

While buying a home can be a great choice in many situations, there are also plenty of times when renting makes more sense. Here’s when you might want to consider renting:

1. You’re Young or not financially ready to buy

Buying a home is a big financial commitment. It can be a rewarding experience but if you are not sure it can turn into a financial blunder in no time.

If you are young or If you’re not quite there yet, renting is a perfectly valid option.

Here are some signs you might not be financially ready to buy-

You don’t have enough saved for a down payment – It is okay but plan on having an emergency fund first.

Your income is unstable or you’re worried about job security- Happens at times, don’t worry things will work out.

If you have significant debt (like student loans or credit card debt) – Clear it first.

Your credit score needs improvement.

Remember, it’s better to wait and build your financial stability than to rush into homeownership before you’re ready.

2. Flexibility

One of the biggest advantages of renting is the flexibility it offers.

If you’re at a stage in your life where you might need to move for work, school, or personal reasons, renting can be a better choice.

Not only does it give you flexibility it also gives you an arbitrage if you know how to use it wisely.

Let me break this down for you.

Imagine you’re a software developer living in San Francisco, where the cost of living is really high.

You’re earning $150,000 per year, which seems like a lot, but rent, groceries, and other expenses eat up a big chunk of it.

Now, think about moving to a smaller city, like Austin, Texas, where the cost of living is much lower. You can keep your same job and salary because you’re working remotely.

Moving to Austin, you might still make that $150,000 but spend way less on housing, food, and other costs. This gives you a higher quality of life with the same income.

This is called location arbitrage—earning money in one (usually high-cost) location while living in a cheaper one, allowing you to save more or enjoy a better lifestyle.

Try it once and thank me later 🙂

3. You’re new to an area

If you’ve just moved to a new city or neighborhood, renting can give you time to get to know the area before committing to a purchase.

You might find that the neighborhood you thought you loved isn’t quite right for you, or discover a different part of town that suits you better.

4. You don’t want the responsibilities of homeownership

Owning a home comes with a lot of responsibilities.

If you’re not ready to deal with maintenance, repairs, property taxes, and all the other tasks that come with homeownership, renting might be a better fit.

As a renter, your landlord is typically responsible for most maintenance and repairs.

Also Read – Home Maintenance- Essential Tips for New Homeowners

5. You’re saving for other financial goals

Maybe you’re focused on paying off student loans, saving for a business venture, or building up your retirement fund.

Renting can allow you to put more money towards these goals instead of tying up your savings in a down payment and home-related expenses.

6. The housing market in your area favors renting

Market Conditions

The state of the housing market in your area can significantly impact whether it’s better to rent or buy. Here’s what to look at:

Home Prices vs. Rent Prices-

Compare the cost of renting to the cost of buying in your area. In some markets, monthly mortgage payments can be lower than rent for a comparable property.

Market Trends-

Is the housing market in your area on an upswing or a downswing? Buying in a rising market could lead to good appreciation, but it also means higher initial costs.

Also Read – Home Appreciation- Understanding How Property Values Grow Over Time

Interest Rates-

Low interest rates can make buying more attractive, as they lead to lower monthly mortgage payments. Keep an eye on current mortgage rates and trends.

Also Read – Mortgage Rates: How They Impact Your Home Buying Power

7. You’re not sure about your long-term plans

If you’re not sure where you want to settle down long-term, renting gives you the flexibility to explore different options.

This is especially true if you’re early in your career, considering further education, or thinking about moving to a different city or country.

8. You prefer a low-maintenance lifestyle

Some people simply prefer the ease of renting. You don’t have to worry about mowing the lawn, fixing the roof, or replacing the water heater.

If you value your free time and don’t want to spend weekends on home maintenance, renting might be the better choice for you.

Conclusion- Your Path Forward

Deciding whether to rent or buy a house is a big decision as well as very personal, but it doesn’t have to be an overwhelming one.

Carefully considering your financial situation, lifestyle needs, long-term plans, and the local real estate market, you can make a choice that aligns with your goals and sets you up for future success.

Remember, there’s no shame or nothing wrong in renting if that’s what makes the most sense for you right now.

Many successful people rent for years before buying, and some choose to rent indefinitely.

On the other hand, if you’re ready for homeownership, it can be an exciting and rewarding journey.

Whatever you decide, make sure it’s a choice that you’re comfortable with and that supports your overall life goals.

Your home, whether rented or owned, should be a place where you feel secure, comfortable, and happy. That’s what matters the most.

Also Read – Owning a Condo vs House: Pros and Cons to Consider

Thanks for reading, If you like my suggestion you can buy me a coffee xoxo –

I drink expensive coffee !! So it’s $100, 😛

Jokes apart your contribution keeps my site running and keeps me motivated, honestly consider this as supporting or Tipping, Thank you once again.