Car engine trouble can be stressful and expensive, often leaving you wondering what to do—and whether your car insurance will cover the costs. Unfortunately, the answer isn’t always straightforward. Coverage depends on several factors, like how the damage happened, the type of policy you have, and any exclusions in your insurance agreement. Understanding these details ahead of time can save you from surprises later.

This blog breaks down when car insurance might help with engine repairs. For example, if your engine’s damaged due to a covered accident or something external like flooding, your policy—like comprehensive or collision coverage—might kick in. But if the damage is from normal wear and tear or neglect, it’s usually not covered.

We’ll walk you through the ins and outs of different auto insurance policies so you can see what’s covered and what isn’t. Whether it’s damage from accidents, natural disasters, or mechanical failure, you’ll get a clearer picture of when your insurance might step in to help. By the end, you’ll have the knowledge you need to make better decisions about your coverage.

If the Engine in My Car Blows Up Through No Fault of My Own, Will My Insurance Pay to Replace It?

If your car’s engine fails unexpectedly, whether your insurance will cover the repairs depends on your policy and what caused the damage. Knowing what’s covered is key to figuring out if you’re eligible for help in situations like this. The two main types of insurance that might apply for engine-related issues are comprehensive and collision coverage.

Comprehensive Insurance covers damage caused by external events like theft, natural disasters, fire, or vandalism. For example, if your engine gets damaged in a flood during a storm or by a fire, this is the type of policy that might help. It’s designed to handle non-accident-related incidents, making it a good safety net for unexpected problems.

Collision Insurance focuses on damage caused by car accidents. If your engine gets damaged in a crash—whether it’s a multi-car pileup or hitting a stationary object—this kind of policy could cover the repairs. It’s especially useful when the damage is directly tied to an accident.

That said, most insurance policies don’t cover engine failure caused by wear and tear, poor maintenance, or neglect. For instance, if your engine blows because you skipped oil changes or didn’t replace a timing belt, you’re out of luck. These are considered preventable issues, which is why staying on top of routine maintenance is so important to avoid expensive repairs.

To avoid surprises, it’s a good idea to understand the details of your insurance policy and keep your car in good shape. Review your policy carefully and talk to your provider to make sure you’ve got the coverage you need. A little preparation now can save you a lot of stress and money later.

Can I Make a Claim on My Car Insurance for a Blown Engine After an Accident?

If your engine gets wrecked in an accident, the solution is pretty straightforward. Collision Insurance is there to cover damage caused by accidents, including your engine. As long as you have this coverage, your insurer will take care of the repair or replacement costs, up to the limits of your policy. Without it, though, you’d probably have to pay for those expensive repairs yourself, which can be a big financial hit.

Here’s how to make a successful claim:

Document the accident well: Take clear photos of the damage from different angles—close-ups and wide shots showing the whole scene. If other vehicles or objects were involved, include them too. Don’t forget to grab a copy of the police report—it’s an important piece of evidence.

Notify your insurance company ASAP: Reach out to your insurer right after the accident. Share all the details, like photos, the police report, and any witness statements, to help your claim go smoothly.

Know your deductible: Before your insurer chips in, you’ll need to pay your deductible. Make sure you know how much it is and have it ready to avoid any delays.

Keep in mind, if the accident was your fault, your premium might go up when you renew your policy. How much it increases depends on your insurer and the situation.

Even so, having collision coverage can save you from the immediate stress of paying for major repairs or a replacement. Make sure to review your policy and double-check that you have enough coverage to handle unexpected expenses.

Will Auto Insurance Cover Damage in the Engine from Mechanic Negligence?

Engine damage caused by a mechanic’s mistakes—like bad repairs, using the wrong parts, or skipping necessary maintenance—is usually not covered by standard car insurance. In these cases, the responsibility typically falls on the mechanic or repair shop that did the work.

If this happens, you’d need to file a negligence claim directly against the mechanic or shop. Most professional mechanics carry liability insurance, which could cover the damage they caused. Be sure to keep detailed records, including receipts, repair documents, and any communication with the mechanic, as this will be important if you decide to make a claim.

Some car insurance providers do offer optional add-ons that cover damages from faulty repairs or mechanical errors. These extras can give you a bit more peace of mind, especially if you rely on repair services often. It’s worth checking with your insurer to see if this is an option, so you’re better protected from unexpected repair issues down the road.

Making a Claim for Insurance to Repair Your Engine

Making a claim for engine damage can feel tricky, but it all depends on your situation—things like what caused the damage and what your insurance policy covers. By sticking to a clear plan, you can save time, reduce stress, and improve your chances of a successful claim. The key steps? Gather your documents, understand your policy, and communicate clearly with the right people. Here’s a step-by-step guide to help you tackle the process smoothly:

Figure Out What Happened

Start by identifying what caused the engine damage. Was it an accident, bad weather (like flooding or hail), or a sudden mechanical problem? Get as much evidence as you can—like photos or videos of the damage—and take detailed notes about what happened. If it was an accident, make sure to grab a copy of any police reports too.

Get in Touch With Your Insurer ASAP

Don’t wait too long to notify your insurance company—many policies have strict deadlines for reporting incidents. Share all the important info like the date, time, and details of what caused the damage. If others were involved (like in an accident), include their details too. Be ready to answer questions and provide initial evidence to back up your claim.

Collect Supporting Documents

To make your claim stronger, pull together as much proof as possible. This might include clear photos of the engine damage from different angles, repair estimates from certified mechanics, and recent maintenance records showing you’ve taken care of your car. The more detailed and organized your submission, the smoother the process will be.

Know Your Coverage

Take a good look at your insurance policy so you fully understand what’s covered, including deductibles and exclusions. Engine repairs or replacements can be expensive, and not every policy covers everything. Knowing the limits of your coverage upfront can help you avoid surprises later on.

Stay on Top of Things

Once you’ve submitted your claim, follow up with your insurer to check on progress. Keep track of all communications—emails, phone calls, and any additional documents you send. Staying organized and proactive can help you avoid delays and resolve any issues quickly.

Being thorough and keeping everything organized, you can make the claims process way less stressful and increase your chances of getting compensated. Preparation and attention to detail go a long way in getting a smoother outcome!

When Does Car Insurance Cover Engine Repair?

Car insurance can cover engine repairs, but it all depends on the specific situations outlined in your policy. Knowing when your insurance kicks in can help you figure out if you’ll get help with repair costs. Here are some common scenarios where engine damage might be covered:

Accidents and Disasters: If your engine gets damaged in a car accident, it’s usually covered under collision insurance. Natural disasters like hurricanes, floods, hailstorms, or falling trees can also cause engine damage, but this is typically handled by comprehensive coverage, which protects you from non-accident-related incidents. So, if your car is caught in a storm or a crash and the engine is affected, your policy might step in to help with repairs.

Unexpected Events: Sudden events, often called “sudden perils,” can seriously mess up your engine. Things like fires, flooding, or falling objects (like tree branches during a storm) can cause costly damage. Thankfully, these emergencies are usually covered by comprehensive insurance. For instance, if a huge branch falls on your car and damages the engine, your policy will likely help cover the repair costs.

Theft or Vandalism: If someone breaks into your car or vandalizes it and the engine or its parts are damaged, your comprehensive coverage can help. Whether the engine gets tampered with during a break-in or intentionally damaged, your insurance may cover the repairs or replacements.

That said, it’s important to know what your policy doesn’t cover. Routine wear and tear, lack of maintenance, or mechanical failures that aren’t caused by a covered event are usually excluded. For example, if your engine breaks down because you skipped regular oil changes, you’ll probably be on the hook for the repair bill.

This is why it’s so important to review your policy’s fine print. Make sure you know what’s covered and what’s not. It’s also a good idea to check your coverage regularly to ensure it matches your needs—especially if you live in an area prone to certain risks like flooding or severe weather. Being informed about your policy can save you from unexpected surprises and give you peace of mind if something goes wrong.

Does “Full Coverage” Car Insurance Cover a Blown Engine?

The term “full coverage” usually refers to a mix of comprehensive and collision insurance policies. These are designed to give your car solid protection, but it’s important to know they don’t cover everything.

What’s Covered: Full coverage typically protects against things like engine damage from accidents, theft, fires, floods, vandalism, or falling objects. Basically, it’s there for external risks that are out of your control.

What’s Not Covered: However, full coverage doesn’t include mechanical breakdowns, wear and tear, or problems caused by poor maintenance. So, if your engine gives out because of age or neglect, those repairs won’t be covered.

It’s important to read through your policy so you know exactly what “full coverage” includes. Despite the name, there are still some gaps, like mechanical failures or routine maintenance. If you want extra protection for things like breakdowns, it might be worth looking into additional options, like mechanical breakdown insurance.

When Won’t an Insurance Company Cover a Car Engine?

Car insurance usually won’t cover engine damage in a few specific situations, like when it’s caused by a lack of maintenance, mechanical failure, or normal wear and tear. Knowing these exclusions is important because they could leave you footing the bill for expensive repairs. Here are the main reasons engine damage typically isn’t covered:

Neglecting Maintenance: If your engine gets damaged because of poor upkeep—like skipping oil changes, ignoring low fluid levels, or brushing off warning lights—it’s seen as preventable and not covered by insurance. For example, if your engine seizes from not changing the oil regularly, your insurer probably won’t help. Keeping up with regular maintenance and fixing small issues early can help you avoid this.

Wear and Tear: Engines naturally wear out over time with regular use. This gradual decline, called wear and tear, isn’t something most insurance policies cover. So, if your engine starts having problems because parts have simply worn out after years of use, you’ll be responsible for the repair costs. Insurance is there to cover sudden, accidental damage—not the predictable stuff that comes from everyday use.

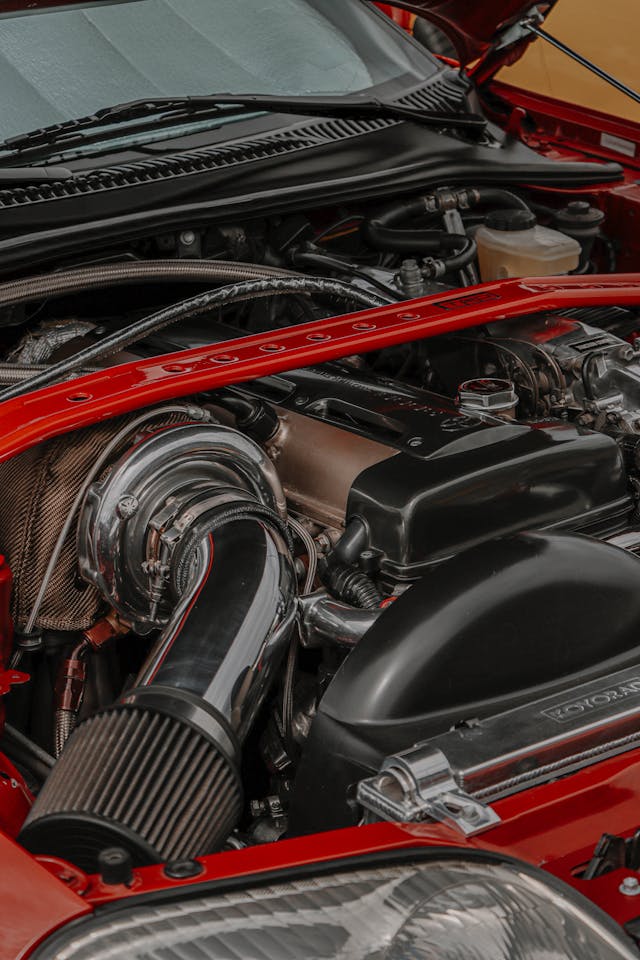

Modifications Without Notice: If you modify your engine (like adding a turbocharger or tuning it) without letting your insurance provider know, it could void your policy. Changes like these can affect your car’s performance and risk level, and if you don’t disclose them, your insurer might reject a claim for engine damage—or even cancel your policy altogether. To stay covered, always let your insurer know about any upgrades or customizations.

Understanding these exclusions can help you stay on top of your car’s maintenance and avoid insurance headaches. Regular servicing and quick repairs can keep mechanical issues at bay, and being upfront with your insurer ensures your policy fits your car’s needs. Taking a little time now to review your insurance terms can save you a lot of stress (and money!) down the road.

Which Policy Add-Ons Should I Consider to Cover My Car Engine?

Standard insurance policies have their limits, but adding extra coverage can give you serious peace of mind—especially when it comes to expensive engine repairs. If you’re looking to boost your protection, here are some options worth checking out:

Mechanical Breakdown Insurance (MBI): This add-on is made to cover major mechanical failures, like engine repairs, which can cost a fortune. MBI is a great option for newer cars in good shape, helping you avoid financial stress when unexpected breakdowns happen. Unlike typical warranties, MBI is usually offered by insurance companies and covers a wide range of components, including the engine, transmission, and drivetrain. It’s a smart move if you want to avoid surprise repair bills.

Roadside Assistance Plans: These plans, either part of an insurance policy or a standalone service, are a lifesaver when you’re stuck on the road. They often include towing, jump-starts, flat tire fixes, and fuel delivery. Plus, many plans offer engine diagnostics to quickly figure out if it’s something minor or a bigger issue like engine trouble. Some even cover small on-the-spot repairs, making sure you’re back on the road with less hassle.

Extended Warranties: Offered by car manufacturers or third-party providers, extended warranties give extra protection after your standard factory warranty runs out. They usually cover essential parts like the engine, transmission, and drivetrain, and sometimes even electrical or hybrid system components. Depending on the provider, you might also get perks like rental car reimbursement or trip interruption coverage, giving you extra convenience and security.

Adding these coverages is a smart way to protect yourself financially and be ready for the unexpected. Options like MBI, roadside assistance, and extended warranties can help you handle sudden breakdowns or costly repairs without the stress. Taking the time to explore these now could save you a ton of trouble later on, making them a great investment for any car owner.

When Your Engine Fails, Preparation is Key

Knowing if your car insurance covers engine repairs can save you time, hassle, and money when the unexpected happens. Your car’s engine is a vital (and complicated) part, so staying prepared for potential issues is a smart move. Most standard insurance policies cover things like accidents, theft, or natural disasters, but they usually don’t include mechanical failures caused by wear, tear, or neglect. So, if your engine breaks down due to lack of maintenance or aging, you’ll likely have to pay for repairs yourself.

To avoid costly surprises, make sure you’re keeping up with regular maintenance—oil changes, inspections, and following the manufacturer’s care recommendations. It’s also a good idea to carefully go over your insurance policy to understand what’s excluded when it comes to engine damage. Many policies outline exactly what’s covered and what isn’t. If your policy doesn’t meet your needs, you might want to look into extras like mechanical breakdown insurance or extended warranties to cover those gaps.

The bottom line? Stay prepared so you’re not caught off guard by unexpected engine repairs. While they can definitely be stressful, a little planning can go a long way in saving you money and frustration. If you’re unsure about your coverage or want more protection, talk to your insurance agent. They can help you explore upgrades and extra coverage that fit your needs, giving you peace of mind no matter what happens on the road—or under the hood.